Mercury Deal 2026 – Banking* for Startups Offer

Written By:

Pradeep Singh

Last Updated: January 4, 2026

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

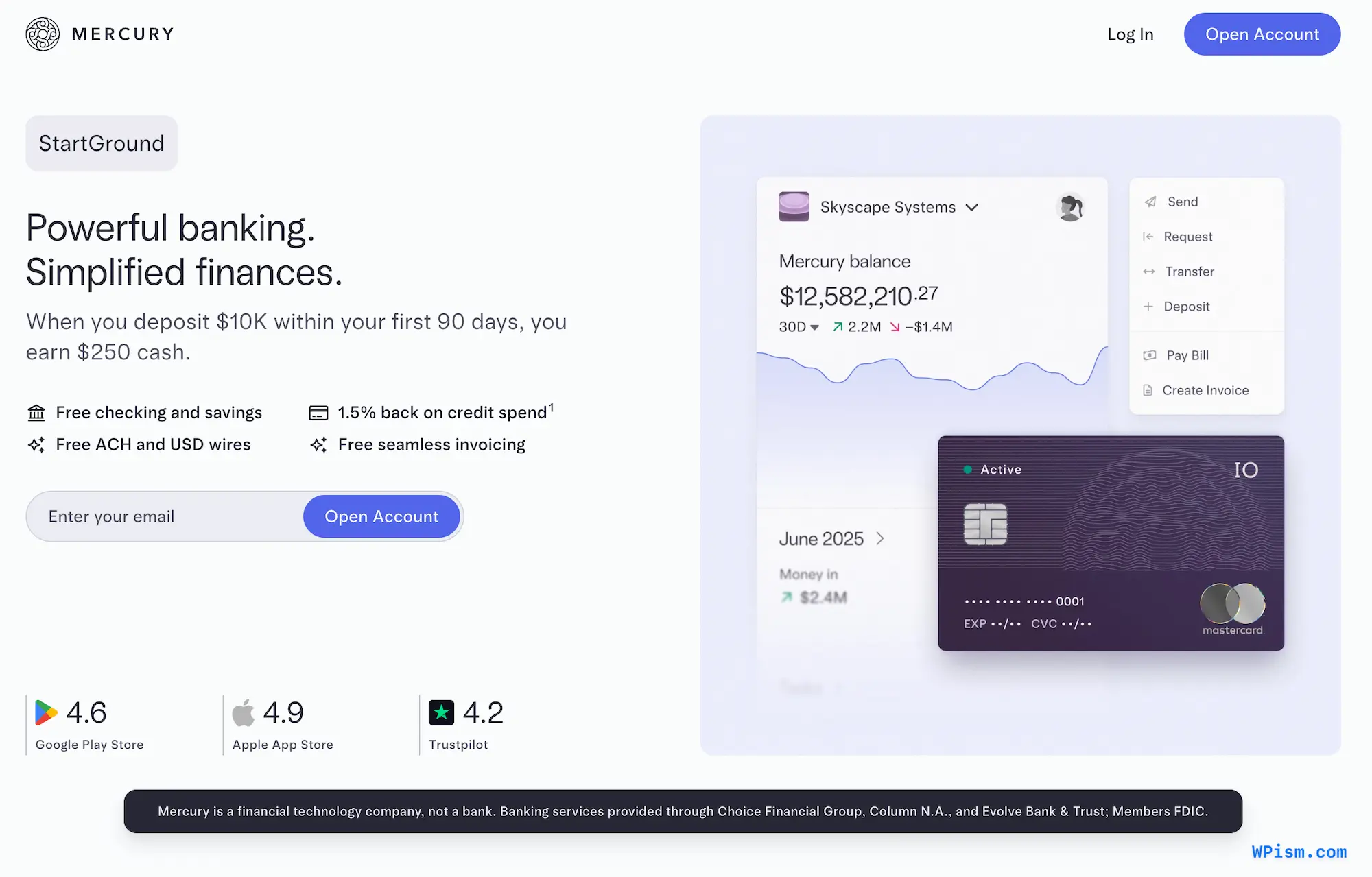

If you’re setting up a new business account, the Mercury deal gives you a strong head start. When you open a Mercury account* and deposit $10,000 within your first 90 days, you receive a $250 cash reward. You start with a platform designed for startups and small businesses, offering modern online banking* with no required monthly fees on standard accounts.

Mercury makes it easier for you to manage your company’s finances from day one. You get access to FDIC-insured checking and savings accounts through Mercury’s partner banks and their sweep networks, physical and virtual debit cards, and seamless domestic and international transfers. The platform also integrates with popular accounting tools, so you can keep your books updated without extra manual work.

This deal is ideal if you want to stretch your budget while gaining access to reliable financial tools. The bonus gives your business a boost, while Mercury’s flexible pricing means you only pay for advanced features when you actually need them.

How to apply for the Mercury Deal?

Claiming the Mercury deal is simple, and you can complete the process entirely online. Here’s how you can do it step by step:

Step 1: Apply for a Mercury account using our exclusive Partner Link

Visit Mercury’s website to get started. You’ll need your company details and registration documents to get started.

Step 2: Verify your business

Submit the required information for verification. Mercury reviews all applications manually, so make sure your business meets the eligibility requirement of being registered in the United States.

Step 3: Fund your account

Deposit at least $10,000 within the first 90 days of opening your account. You can transfer funds directly from your existing bank or investor account. See Mercury’s Customer Referral Agreement for full terms and conditions by visiting this link.

Step 4: Receive your bonus

Once you meet the deposit requirement, Mercury adds the $250 bonus directly to your account. This is available to use just like your regular funds.

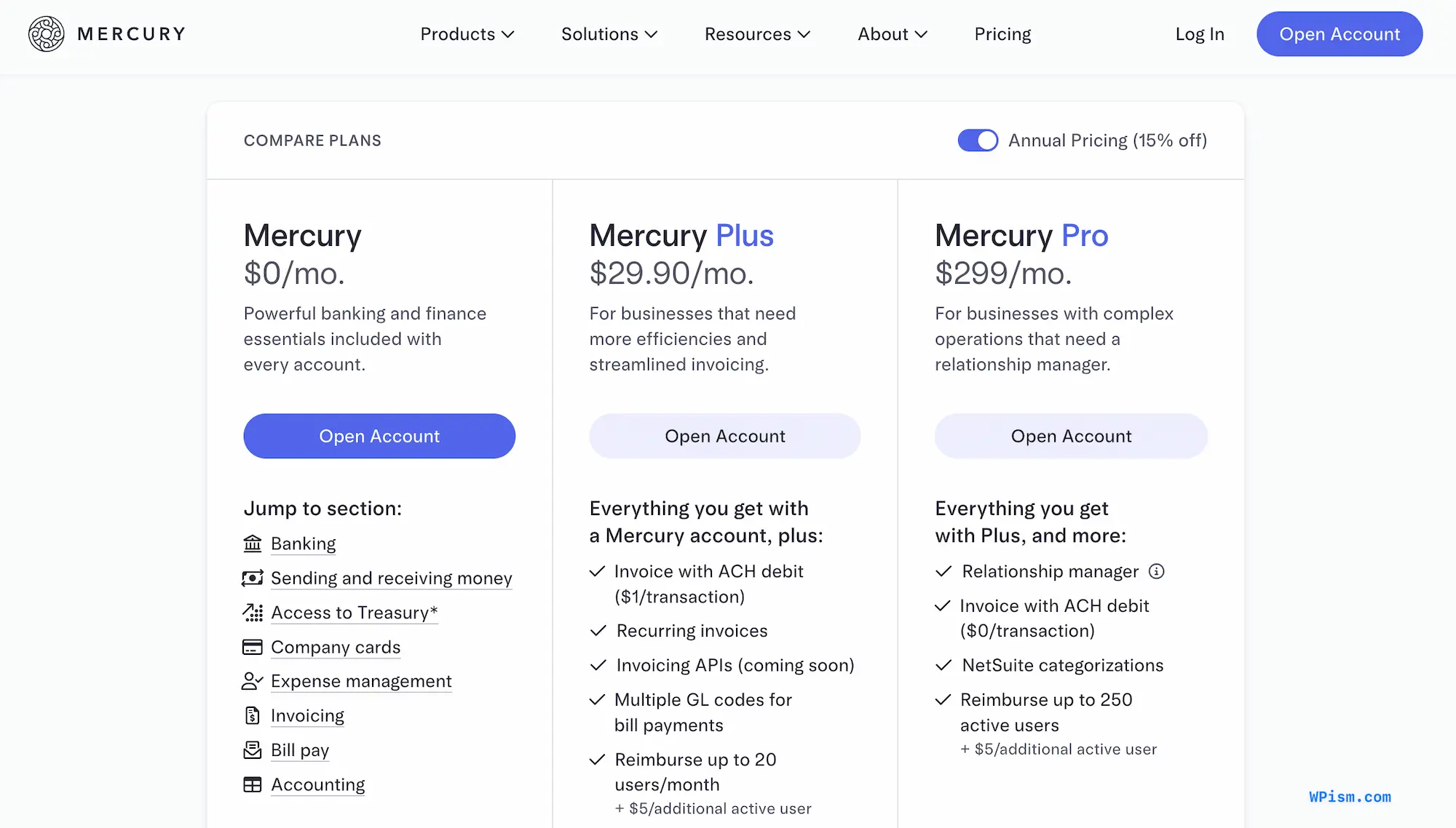

Mercury Discounted Pricing Plans

Mercury makes its pricing structure straightforward, so you can start for free and only upgrade when your business demands more advanced tools.

The standard plan covers essential banking* features without monthly fees, while the paid tiers unlock advanced features for invoicing, reimbursements, dedicated support, and more. You also save 15 percent when you choose annual billing for the Plus or Pro plans.

Here’s a clear breakdown of Mercury’s plans:

| Plan | Monthly Price | Annual Price (15% OFF) | Best For |

|---|---|---|---|

| Mercury (Standard) | $0 | $0 | Founders who need essential banking without hidden fees. |

| Mercury Plus | $35/month | $299/year | Growing businesses that need invoicing tools, ACH debit, and reimbursements for up to 20 users. |

| Mercury Pro | $350/month | $2,995/year | Larger teams requiring advanced features, expanded reimbursements for up to 250 users, and a dedicated relationship manager. |

You can begin with the standard plan and switch to a paid option once you need more control over invoicing and team expenses. The annual discount makes the higher tiers cost-effective, if you know your business will rely heavily on Mercury’s advanced capabilities.

What is Mercury?

Mercury is a modern financial technology platform created to simplify business banking for startups and small businesses. Instead of relying on outdated systems, you get a fully digital experience that lets you open and manage your account online without dealing with the usual paperwork and delays of traditional banks.

The platform provides you with access to FDIC-insured checking and savings accounts through Mercury’s partner banks and their sweep networks, along with debit and credit cards for daily operations. You can send and receive domestic and international transfers in USD for no fees, manage bills, and create invoices, all from a clean and intuitive dashboard.

Mercury also integrates seamlessly with accounting software like QuickBooks, Xero, and NetSuite, so your financial data stays accurate without extra manual input. Beyond the basics, it offers advanced options such as Mercury Treasury***, which helps you earn yield on idle balances and growth resources.

By focusing on startups, Mercury delivers the kind of flexibility and transparency that early-stage businesses need. You avoid unnecessary fees, gain advanced financial tools as your company grows, and get access to programs designed to support your funding and scaling journey.

Mercury Main Features

Mercury gives you far more than a simple checking account. It combines essential banking services with modern tools that help you run your finances efficiently and scale smoothly. Here are the core features you can expect:

Banking and Payments

You can apply for access to FDIC-insured checking and savings accounts* provided through Mercury’s partner banks, with no required monthly fees or minimum balance requirements. Sending domestic and international USD wires is free, and you get unlimited ACH transfers and bill payments without surprise charges.

Company Cards

Mercury issues both physical and virtual debit and credit cards**. Every purchase earns 1.5 percent cashback****, turning everyday business spending into valuable savings. You can also issue multiple cards to your team, with permissions and limits tailored to your needs.

Expense Management

Managing reimbursements becomes simple with Mercury. The standard plan supports a small team, while the Plus and Pro tiers expand coverage to 20 and 250 users respectively. Built-in controls help you monitor spending across departments and keep budgets under control.

Invoicing and Bill Pay

You can generate unlimited invoices directly through the platform. Paid plans unlock features like recurring invoices, ACH debit for clients, and advanced categorization options that make accounting smoother.

Integrations and Automation

Mercury connects with QuickBooks, Xero, and NetSuite, so your transactions sync automatically. For scaling businesses, APIs and automation options reduce repetitive tasks and streamline financial workflows.

Treasury and Yield Options

If your balance reaches 250,000 dollars, you gain access to Mercury Treasury by Mercury Advisory***, a service that invests idle funds in safe, high-yield options. This helps your cash generate returns without extra complexity.

Security and Compliance

You benefit from strong protections including two-factor authentication, fraud monitoring, and detailed activity logs. Through its partner banks, Mercury extends FDIC insurance coverage far beyond the standard 250,000 dollar limit, which is particularly valuable for startups holding larger balances.

All Mercury Deals and Offers

Mercury regularly introduces deals that give startups and small businesses an extra boost.

The urrent highlight is the $250 cash bonus you receive when you deposit $10,000 within your first 90 days of opening an account. This offer is designed to reward you right at the beginning of your journey, making it easier to reinvest in your company.

Alongside the bonus, you also benefit from Mercury’s transparent pricing and discounts on paid plans. By choosing annual billing for Mercury Plus or Pro, you save 15 percent compared to monthly payments. This makes advanced features like expanded reimbursements, invoicing APIs, and a dedicated relationship manager more affordable.

Mercury also adds value beyond direct discounts. With programs like Mercury Raise, you get opportunities to connect with top investors, attend exclusive startup events, and access mentorship resources. For founders preparing for seed or Series A rounds, these connections can make a real difference.

When you combine the deposit bonus, the annual plan savings, and the community resources, Mercury’s deals create a strong financial and strategic advantage for your business.

Mercury Deal FAQs

Here are some of the FAQs about Mercury deals and offers and how it works.

How does the Mercury deal work?

You open a Mercury account and deposit at least 10,000 dollars within the first 90 days. Once you meet this requirement, Mercury credits the promo amount directly to your account. See Mercury’s Customer Referral Agreement for full terms and conditions.

Who can claim the Mercury bonus offer?

This deal is available to US-based businesses. You need to have a registered company in the United States to qualify.

Do I need a paid plan to access the Mercury deal?

No. You can sign up for the free standard plan and still receive this promo reward. Paid tiers are optional if you want additional features.

How soon do I get the promotional Mercury credit?

Mercury processes the bonus shortly after you meet the deposit requirement. The funds appear directly in your account balance.

Can I combine this Mercury deal with other promotions?

This cash reward is Mercury’s primary promotional offer. You may also benefit from annual discounts on paid plans or resources from programs like Mercury Raise.

Start with Mercury Deal

The best way to experience Mercury is to take advantage of the current deal. It’s a simple offer that gives your startup an immediate boost while you gain access to a modern banking platform built for founders.

You don’t need to worry about hidden fees or minimum balances on the standard plan, and you can upgrade later to unlock advanced features at a discounted annual price. This makes the Mercury deal one of the most cost-effective ways to start managing your business finances with professional-grade tools.

Mercury

Mercury gives you a smarter way to handle your business finances with a platform designed specifically for startups and growing companies.

Price Currency: USD

Application Category: FinanceApplication

5

Pros

- No monthly fees on standard accounts

- Seamless integrations with QuickBooks, Xero, and NetSuite

- FDIC coverage* far above standard limits

Cons

- Reimbursement limits on lower-tier plans

- Limited options for physical checks

- Some ACH debit features add extra costs

By starting with this deal, you put extra money back into your budget and position your company with a banking partner that scales with your growth. It’s a smart first step toward building a strong financial foundation for your business.

Mercury is a fintech company, not an FDIC-insured bank. Checking and savings accounts are provided through our bank partners Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC. Deposit insurance covers the failure of an insured bank. Checking and savings account deposits may be held by sweep network banks. Certain conditions must be satisfied for pass-through insurance to apply. Learn more here.

**The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®. To receive cash back, your Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.

***Mercury Treasury, offered by Mercury Advisory, LLC, an SEC-registered investment adviser, seeks to earn net returns up to 4.26% annually on your idle cash. Net return or yield provided assumes total Mercury deposits of $20M+, is accurate as of 09/01/2025, and is subject to change.

This communication does not constitute an offer to sell or the solicitation of any offer to purchase any security. Funds in Mercury Treasury are subject to investment risks, including possible loss of the principal invested, and past performance is not indicative of future results. Some of the data contained in this message was obtained from sources believed to be accurate but has not been independently verified. Please see full disclosures at mercury.com/treasury. Mercury Advisory is a wholly-owned subsidiary of Mercury Technologies.

Mercury Treasury is not insured by the FDIC. Funds in Mercury Treasury are not deposits or other obligations of Choice Financial Group, Column N.A., or Evolve Bank & Trust, and are not guaranteed by Choice Financial Group, Column N.A., or Evolve Bank & Trust.

Tags:

Author: Pradeep Singh

Pradeep Singh is the founder and your host here at WPism. He is an entrepreneur and blogger living his startup life based in London and Cambridge. Connect with him on LinkedIn, follow him on Twitter or like his page on Facebook.